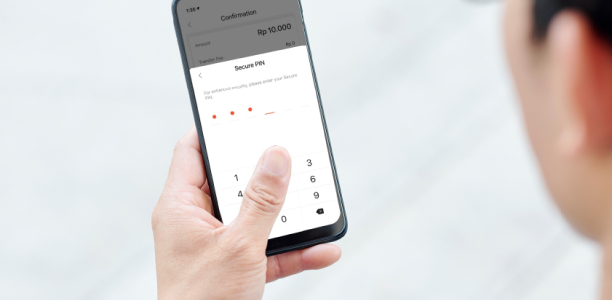

Apa Saja yang bisa Kamu Lakukan di SeaBank?

Tabungan

Bunga cair setiap hari

Deposito

Bunga Tinggi hingga 6% p.a.

Transfer

Gratis biaya transfer

Tagihan

Lebih mudah di SeaBank

QRIS

Lebih mudah di SeaBank

PT Bank Seabank Indonesia berizin dan diawasi oleh Otoritas Jasa Keuangan (OJK) serta merupakan bank peserta penjaminan Lembaga Penjamin Simpanan (LPS)